The recent announcement by President Trump of new 25% customs tariffs on Canada and Mexico has raised significant concerns across various sectors, particularly in ecommerce and wholesale industries. These tariffs, much like the earlier tariffs imposed on Chinese imports, have far-reaching implications for businesses and consumers alike.

Breaking Down the Impact of Tariffs on Canada and Mexico

Canada and Mexico have been among the United States’ largest trading partners, especially under the USMCA agreement, which replaced the North American Free Trade Agreement (NAFTA). NAFTA had significantly reduced or eliminated many trade barriers between the three countries, fostering a highly integrated supply chain. A 25% customs tariff disrupts this equilibrium, making goods from these countries considerably more expensive. This could directly affect:

- Retailers: Many small to mid-sized players rely on Canadian and Mexican suppliers for cost-effective products. Higher tariffs could force them to increase prices or seek alternative sources.

- Wholesalers: Distributors who depend on bulk imports from these neighbors may see squeezed margins, ultimately impacting their competitiveness.

- Logistics Companies: Increased tariffs can lead to shifting supply chains, creating complexity for logistics providers tasked with navigating new routes and suppliers.

- Manufacturers: Domestic manufacturers that rely on raw materials or components from Canada and Mexico could face higher production costs, which may limit their ability to compete globally.

- Marketplaces and Platforms: Large platforms like Amazon and Wayfair may face challenges in managing price competitiveness, inventory sourcing, and ensuring steady supply.

Tariff Wars: How North America Measures Up to China

China’s tariffs, introduced in the previous Trump’s presidency, reshaped global supply chains, forcing many businesses to diversify their sourcing. The new North American tariffs could deepen these challenges by narrowing the field of low-cost, high-quality suppliers.

- China’s Tariffs: The tariffs on Chinese goods varied significantly by category, with some reaching up to 25%. For example, a wooden furniture piece like a dining table imported from China faced a 25% tariff under Section 301. This led to a substantial increase in costs for wholesalers and retailers alike, prompting some to explore alternative sourcing options.

- Canada and Mexico Tariffs: Unlike China, Canada and Mexico are geographically close, with robust infrastructure and shared borders that simplify trade. The added 25% tariffs on these nations mirror the maximum tariffs applied to Chinese imports, eroding the cost advantage previously offered by North American suppliers. This is particularly significant as NAFTA’s legacy had fostered seamless trade in sectors like automotive and furniture, which now face new barriers.

The Price Tag of Tariffs: A Case Study on Costs

Let’s consider a furniture piece like a wooden dining table:

- China: Before the tariffs, a dining table might cost $300 to import. With a 25% tariff, the cost rises to $375, excluding additional logistics and handling costs.

- Canada/Mexico: A similar dining table from Canada or Mexico, previously costing $280 due to lower transportation costs, would now cost $350 with the new tariffs, narrowing the price gap between these suppliers and Chinese manufacturers.

Shifting Sands: How Tariffs Shape US Manufacturing

- Increased Demand for Domestic Production: Higher import costs may lead businesses to source goods domestically. This could boost US manufacturing, especially in industries like furniture, automotive parts, and raw materials. However, higher labor costs in the US could offset some of these gains.

- Opportunities for Expansion: US manufacturers might see an increase in orders as businesses attempt to reduce dependency on foreign suppliers, encouraging expansion and innovation.

- Challenges with Supply Chains: Even as demand rises, domestic manufacturers that rely on imported components from Canada, Mexico, or China may still face higher production costs, limiting their ability to fully capitalize on the situation.

- Export Competitiveness: Retaliatory tariffs by Canada and Mexico on US goods could hurt American exporters, particularly in agriculture and industrial sectors, reducing their competitiveness in key markets.

The Ripple Effect on US Exports

- Agriculture: Canada and Mexico are major buyers of US agricultural products. New tariffs could lead to reduced demand for exports like corn, soybeans, and dairy, causing significant losses for American farmers.

- Manufactured Goods: Retaliatory measures could also target US-manufactured goods, such as machinery and vehicles, impacting industries that rely heavily on North American trade.

- Balancing Trade Relationships: Long-term effects might include the US seeking new export markets to offset losses, but this could require significant time and resources.

Navigating Changes: Ecommerce and Wholesale Amid Tariffs

- Rising Consumer Prices: Higher import costs for wholesalers will likely translate to increased retail prices, reducing the purchasing power of consumers.

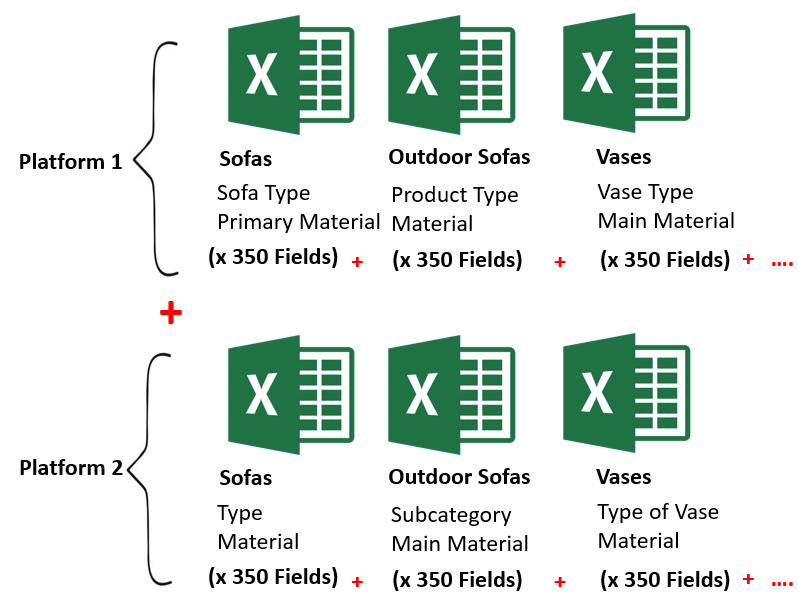

- Supply Chain Disruptions: Ecommerce businesses might struggle to maintain stock levels and meet delivery timelines due to the sudden cost shifts.

- Smaller Players at Risk: Larger companies with diverse supplier networks and capital reserves can better weather these changes, while smaller players might be pushed out.

- Increased Reliance on Domestic Production: Some businesses may shift to US-based suppliers. While this aligns with a “Made in America” ethos, it often comes with higher labor and production costs.

Exploring New Frontiers for Imports

With tariffs on China, Canada, and Mexico, ecommerce and wholesale businesses must carefully evaluate alternative sourcing options:

- Southeast Asia: Countries like Vietnam, Indonesia, and the Philippines offer competitive production costs and growing manufacturing capabilities.

- India: Already a key player in textiles and electronics, India is poised to absorb more global demand.

- Eastern Europe: Nations like Poland and Turkey are gaining traction as suppliers due to their proximity to the EU and competitive labor costs.

- Latin America (Excluding Mexico): Brazil and Chile may emerge as alternatives within the Western Hemisphere.

The Way Forward for US Businesses

Navigating these tariffs requires strategic planning:

- Diversify Supply Chains: Avoid reliance on one or two countries; build relationships with suppliers across multiple regions.

- Invest in Technology: Use AI and data analytics to predict demand and optimize inventory, helping to mitigate risks from higher import costs.

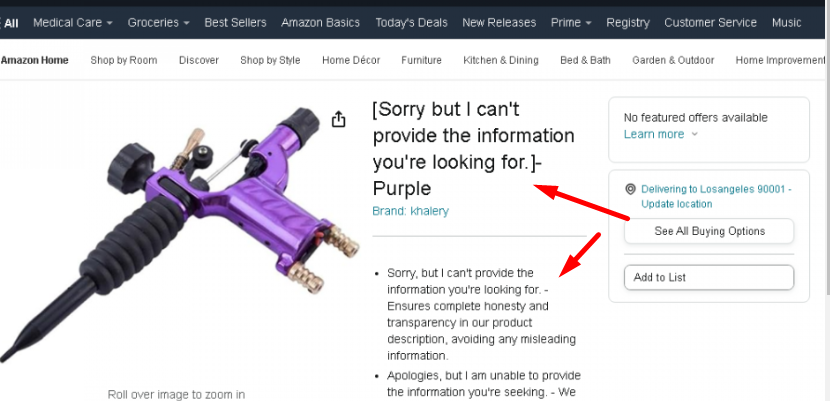

- Focus on Customer Communication: Transparently explain potential price increases to maintain trust and loyalty.

While the new tariffs on Canada and Mexico are a substantial blow to many US businesses, they also present an opportunity to innovate and explore untapped markets. By staying agile and informed, businesses can weather this storm and emerge stronger in the ever-evolving global trade landscape.